Q1 Market Insights MidCounties

| q1-2024-market-insight-midcounties.pdf | |

| File Size: | 1888 kb |

| File Type: | |

Lee Orange Top Five 2023

| 1031_exchange_trends_and_info_for_2024___ipx1031.pdf | |

| File Size: | 56 kb |

| File Type: | |

April 2024

By IPX1031 Insight Blog : https://www.ipx1031.com/1031-trends-2024/?utm_source=news&utm_medium=blst&utm_campaign=mobf

By IPX1031 Insight Blog : https://www.ipx1031.com/1031-trends-2024/?utm_source=news&utm_medium=blst&utm_campaign=mobf

| ocbj_ad_feb_2024_full_page_v3.pdf | |

| File Size: | 534 kb |

| File Type: | |

February 2024

By Lee & Associates

By Lee & Associates

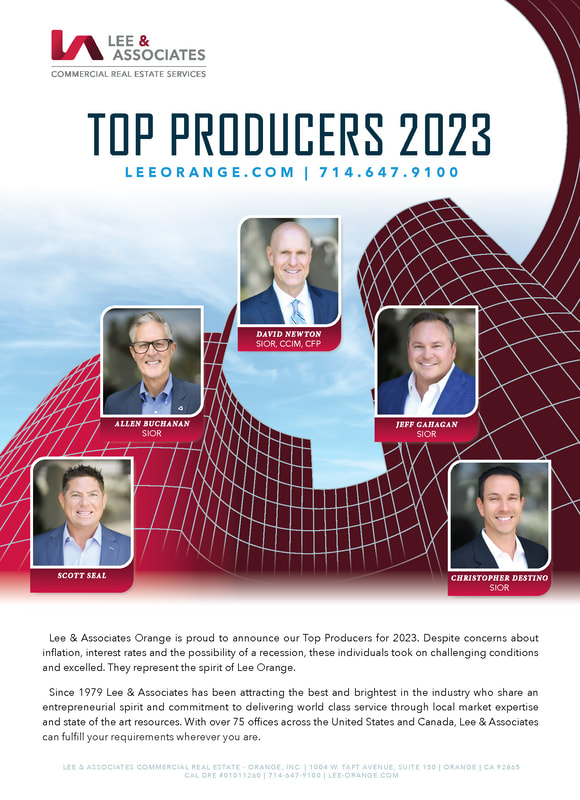

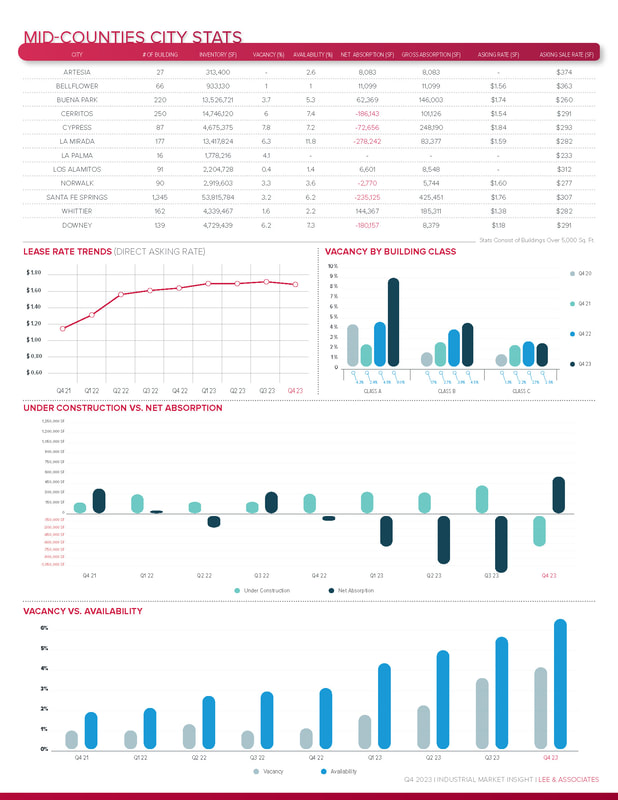

Q4 2023 Industrial Market Insight

| q4_2023_-_market_insight.pdf | |

| File Size: | 1114 kb |

| File Type: | |

February 2024

By Lee & Associates

By Lee & Associates

Chapman University Economic Forecast Presentation

January 2024

By Chapman University

By Chapman University

Will Cooling Activity Levels Affect the Outlook for the Future?

| socals_industrial_real_estate__will_cooling_activity_levels_affect_the_outlook_for_the_future__-_los_angeles_business_journal.pdf | |

| File Size: | 263 kb |

| File Type: | |

October 2023

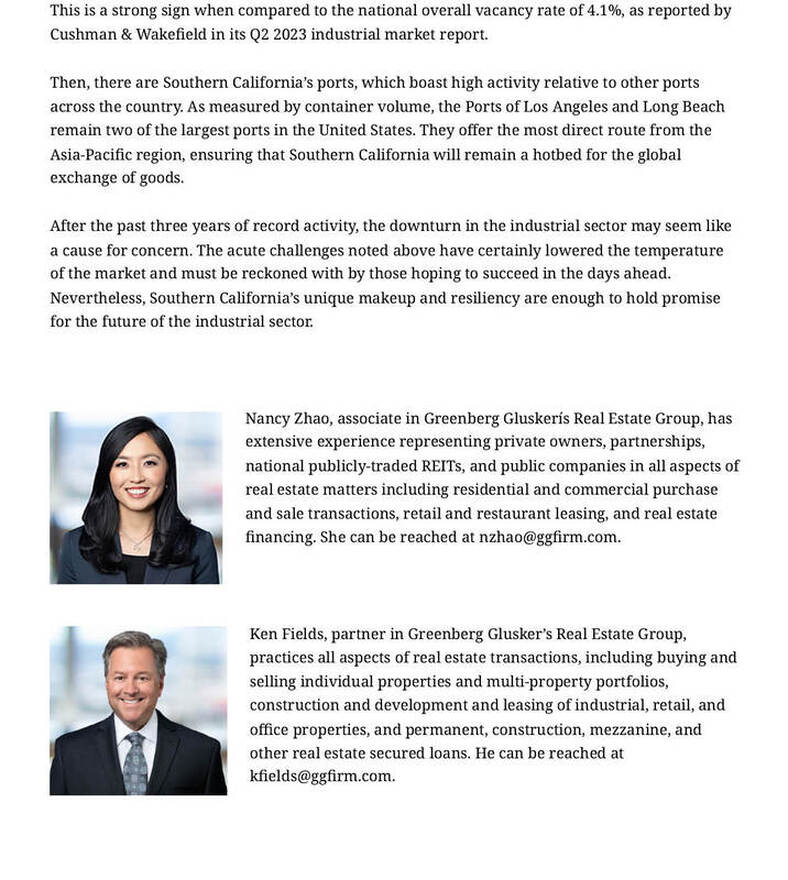

By NANCY ZHAO AND KEN FIELDS | labusinessjournal.com

By NANCY ZHAO AND KEN FIELDS | labusinessjournal.com

National Industrial Report - August

| commercialedge-industrial-report-august-2023.pdf | |

| File Size: | 993 kb |

| File Type: | |

September 2023

By EVELYN JOZSA | commercialedge.com

By EVELYN JOZSA | commercialedge.com

Q1 Industrial Market Insight 2023

| q1_2023-market_insight.pdf | |

| File Size: | 5468 kb |

| File Type: | |

July 2023

By Lee & Associates Los Angeles Central | Industry

By Lee & Associates Los Angeles Central | Industry

| navigating_cam_expenses.pdf | |

| File Size: | 55 kb |

| File Type: | |

June 2023

By Bryan Mashian, Esq.

By Bryan Mashian, Esq.

Wharton professor Jeremy Siegel says he sees a stronger US economy ahead - and suggests investors should stop throwing temper tantrums over high inflaô€€on

| wharton_professor_jeremy_siegel_says_he_sees_a_stronger_us_economy_ahead.pdf | |

| File Size: | 171 kb |

| File Type: | |

March 2023

INFLATION, THE ECONOMY, AND COMMERCIAL REAL ESTATE

| 2022.08-inflation-the-economy-and-cre.pdf | |

| File Size: | 735 kb |

| File Type: | |

September 2022

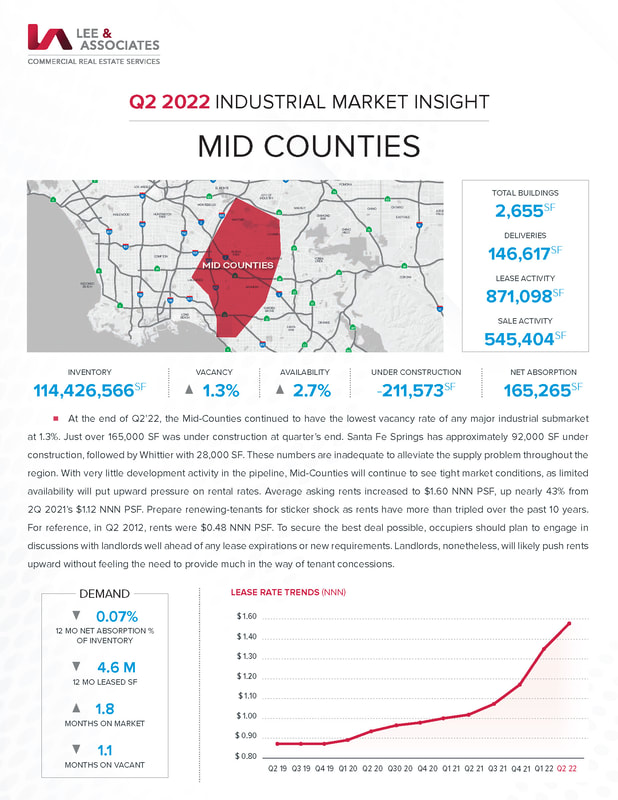

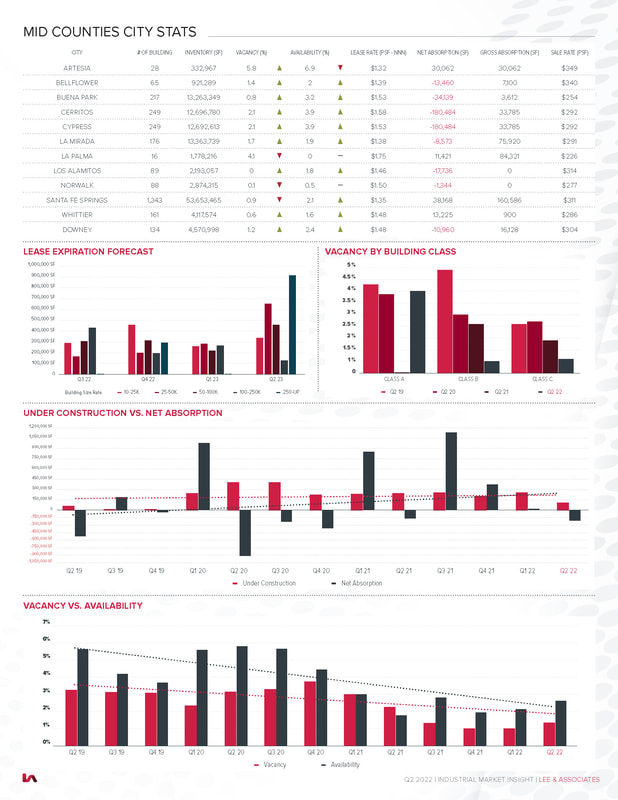

Q2 2022 Mid-Counties Market Insight

| q2_2022_marketinsight.pdf | |

| File Size: | 1770 kb |

| File Type: | |

August 2022

DST 1031 Exchanges – An Option to Keep on Your 1031 Radar

Originally posted on IPX1031 Insight Blog

June 2022

DSTs – An Intriguing Armchair Investment for 1031In today’s 1031 Exchange market, Delaware Statutory Trusts (DSTs) may offer an intriguing option for investors who are looking for properties to complete their 1031 Exchanges.

Why? DSTs are passive management/current income investment opportunities where investors do not have the typical responsibilities associated with actively managing investment properties. Also DST investment offers a convenient and timely 1031 Replacement Property solution when the market for traditional commercial/investment properties is tight.

What is a DST 1031 Exchange? A DST 1031 Exchange is where the investor sells their current investment property and completes their 1031 Exchange by purchasing DST interests as their Replacement Property. Read the how to specifics in How to Identify DST Properties in 1031 Exchanges.

What is a DST?A DST is a legal entity created as a trust under Delaware law that holds one or more pieces of real property in which investors can purchase an ownership interest. The property(ies) are held, managed, administered, and/or operated for profit by a trustee for the benefit of the holders of the DST, creating a passive investment opportunity for the investor. A DST may consist of a varied or targeted portfolio of property types, sponsors, geographical locations and asset classes such as student housing, storage facilities, apartment buildings, hotels, drugstores, office buildings, or health care facilities.

According to DST proponents, these are some of the benefits of DST ownership:

Of course, DSTs are not suited for all. Investors who enjoy managing the day-to-day operations of their properties may not be good candidates. A DST is also not for an investor who wishes to invest in property for a short period since DST investments are typically designed for a holding period of 2 to 10 years or more. Additionally, DSTs are designed for “accredited investors” which are high net worth individuals as defined by the SEC. And with all investments, the fees need to be considered.

Given the intricacies of purchasing suitable real estate assets and structuring these offerings from both a securities and tax perspective, exchangers and their financial advisors should perform due diligence to determine if a DST is right for their investment situation. The DST sponsor will provide a Private Placement Memorandum (“PPM”) which provides information about the properties, area demographics, leases, projections and other important disclosures. Due diligence emphasis should be placed on real estate, property management and asset management expertise, prior performance track record, experience with sophisticated financing structures, transparent investor communications, financial strength of the sponsor and excellent legal representation.

About IPX1031At IPX1031, we pride ourselves on being the industry leader in 1031 expertise, service and security. We aim to be your complete information resource and look forward to helping you and/or your clients maximize qualifying investments through a 1031 Exchange strategy. For more information about 1031 tax deferral strategy, our company, our complimentary 1031 Exchange webinars, or to initiate an exchange, visit our website at www.ipx1031.com or email or call today.

June 2022

DSTs – An Intriguing Armchair Investment for 1031In today’s 1031 Exchange market, Delaware Statutory Trusts (DSTs) may offer an intriguing option for investors who are looking for properties to complete their 1031 Exchanges.

Why? DSTs are passive management/current income investment opportunities where investors do not have the typical responsibilities associated with actively managing investment properties. Also DST investment offers a convenient and timely 1031 Replacement Property solution when the market for traditional commercial/investment properties is tight.

What is a DST 1031 Exchange? A DST 1031 Exchange is where the investor sells their current investment property and completes their 1031 Exchange by purchasing DST interests as their Replacement Property. Read the how to specifics in How to Identify DST Properties in 1031 Exchanges.

What is a DST?A DST is a legal entity created as a trust under Delaware law that holds one or more pieces of real property in which investors can purchase an ownership interest. The property(ies) are held, managed, administered, and/or operated for profit by a trustee for the benefit of the holders of the DST, creating a passive investment opportunity for the investor. A DST may consist of a varied or targeted portfolio of property types, sponsors, geographical locations and asset classes such as student housing, storage facilities, apartment buildings, hotels, drugstores, office buildings, or health care facilities.

According to DST proponents, these are some of the benefits of DST ownership:

- DSTs may offer higher quality, investment-grade assets that are typically only available to large institutions

- DSTs provide investors with income via cash distribution potential

- DST packages offer convenience for exchangers for specific amounts of investment, speed and certainty of close for Replacement Property

- DST fractional ownership allows investors to diversify their capital to invest across multiple DST offerings

- DST investors do not need to manage or participate in day-to-day operations

- DST debt is non-recourse, which means that in the event of a default, DST investors are not personally liable

Of course, DSTs are not suited for all. Investors who enjoy managing the day-to-day operations of their properties may not be good candidates. A DST is also not for an investor who wishes to invest in property for a short period since DST investments are typically designed for a holding period of 2 to 10 years or more. Additionally, DSTs are designed for “accredited investors” which are high net worth individuals as defined by the SEC. And with all investments, the fees need to be considered.

Given the intricacies of purchasing suitable real estate assets and structuring these offerings from both a securities and tax perspective, exchangers and their financial advisors should perform due diligence to determine if a DST is right for their investment situation. The DST sponsor will provide a Private Placement Memorandum (“PPM”) which provides information about the properties, area demographics, leases, projections and other important disclosures. Due diligence emphasis should be placed on real estate, property management and asset management expertise, prior performance track record, experience with sophisticated financing structures, transparent investor communications, financial strength of the sponsor and excellent legal representation.

About IPX1031At IPX1031, we pride ourselves on being the industry leader in 1031 expertise, service and security. We aim to be your complete information resource and look forward to helping you and/or your clients maximize qualifying investments through a 1031 Exchange strategy. For more information about 1031 tax deferral strategy, our company, our complimentary 1031 Exchange webinars, or to initiate an exchange, visit our website at www.ipx1031.com or email or call today.

| 2022.04-life-science-thiving-as-never-before.pdf | |

| File Size: | 469 kb |

| File Type: | |

May 2022

| 2022.01-seven-things-to-know-about-cre-in-2022.pdf | |

| File Size: | 1064 kb |

| File Type: | |

February 2022

| 2021.12-supply-chain-issues-a-critical-analysis.pdf | |

| File Size: | 787 kb |

| File Type: | |

December 2021

| 2021.08-the-changing-nature-of-industrial-demand.pdf | |

| File Size: | 871 kb |

| File Type: | |

September 2021

Growing Southern California Industrial Demand Creates Shifts in Strategy, Outlook

Posted on August 5, 2021 by Sarah Daniels

Industrial real estate in Southern California has become what one might conservatively call a “fast-paced atmosphere.” The presence of multiple offers, sellers pushing up values and buyers continuing to chase deals have made for constantly increasing values and activity. Christopher J. Destino, SIOR, principal at Lee & Associates, spoke to REBusinessOnline about making strategic decisions in this unusual environment.

REBusiness: What is the forecast for demand in industrial properties in Southern California?

Destino: The future of demand in the area is very strong, with developers seeking new sites aggressively and underwriting steady future rent growth over the next couple of years. A lot of that is driven by e-commerce, and there’s still so much room to grow in the e-commerce world. E-commerce accounted for approximately 13.6 percent of retail sales in the first quarter of 2021 (a number that is steadily increasing). There is still a lot of room for that percent to increase, and that’s what is driving most industrial demand.

REBusiness: What are the types of tenants have the most demand for space right now?

Destino: The big three are distribution companies, contractors and service-type industries. There is a still a small manufacturing base, but those are the three that are largely getting the deals.

Distribution companies have all sorts of all product types: high dollar value products to regular homewares, and everything in between. Distribution also includes freight forwarding and third-party logistics companies that store and move around other company’s products. It also includes traditional companies that own, store and deliver their own product directly.

Contractors (plumbers and electricians, for example) tend to be service related and have a fleet of vehicles that need to go out to various job sites. They often occupy industrial spaces. These industries are very busy these days.

REBusiness: What types of buildings are favored amongst industrial spaces?

Destino: When you think of the buildings that would fall under the distribution-type use, they’re going to feature higher ceilings and ample dock loading positions, with quality turning radius for trucks to come and go and distribute product. Those are the number one sought-after deals right now, and they are e-commerce driven. That’s what users want and what developers are building. Other types of industries that are absorbing space (the contractors and service industries) can get away with lower-clear/ground-level loading buildings, but distribution companies are driving the market charge in terms of what is desired for buildings.

REBusiness: What makes Southern California such a healthy market for industrial?

Destino: The proximity to the Port of Long Beach and Port of Los Angeles are the primary drivers. Second is just the sheer population/consumer base that is here. There’s nearly 14 million people in the greater Los Angeles & Orange County area alone. Plus, it’s a huge distribution channel to much of the United States right through these ports.

REBusiness: How has industrial evolved over the past few years?

Destino: Over the last seven or so years, the market has tried to adjust to deal with the e-commerce revolution. That’s why there is nearly 20 million square feet of industrial space that has being built in the Inland Empire every year for the last several years: most of that is getting absorbed by e-commerce-related outfits, in one way or another. That is the evolution: older manufacturing sites, over the last seven to ten years, have either been converted to distribution space (specifically high-cube distribution space) or (in the past) they were converted to multifamily developments.

There is still a manufacturing element for Southern California/Orange County industrial. But it’s mostly higher-end products with higher markups/higher dollar values. These tends to be more specialty products that have low overall volume. Most high-volume manufacturing is going out of the state or out the country entirely.

We’re also starting to see more cold storage, food-distribution-type facilities. Similar to the trends we’ve seen with general merchandise, there’s now an emphasis on establishing direct-to-consumer food delivery channels. Especially in Southern California, people want healthier, locally sourced or organic food. Food needs to be moved from its point of origin to the consumer’s plate faster than ever before. There’s a push for cold storage, but you’re not seeing a lot of spec development for it. I think that demand will persist.

REBusiness: Low vacancy rates can mean multiple offers on available spaces — what is the breakdown for properties getting multiple offers amid so much demand?

Destino: There are a few properties that might have some sort of challenge, and those are not going to get the same volume of activity. But most deals have multiple offers.

When selecting the winning bidder, the use for the property is something to be considered. Even more important is the credit worthiness of any tenant in a lease consideration, as well as the available source of funds for a buyer. Many sales are cash deals, and the tenants that are winning a multiple bid scenario are larger credit tenants, making it difficult for smaller local regional companies to compete.

REBusiness: What’s an unexpected, potential field for industrial in the future, one that you are watching?

Destino: I’ve been expecting to see a big push for some medical device and medicine production coming back to the United States. More could be coming later, as these are costly facilities to set up. It would certainly impact industrial properties, and some of these older manufacturing buildings could, potentially, get rejuvenated.

This article was written in conjunction with Lee & Associates, a content partner of REBusinessOnline.

Industrial real estate in Southern California has become what one might conservatively call a “fast-paced atmosphere.” The presence of multiple offers, sellers pushing up values and buyers continuing to chase deals have made for constantly increasing values and activity. Christopher J. Destino, SIOR, principal at Lee & Associates, spoke to REBusinessOnline about making strategic decisions in this unusual environment.

REBusiness: What is the forecast for demand in industrial properties in Southern California?

Destino: The future of demand in the area is very strong, with developers seeking new sites aggressively and underwriting steady future rent growth over the next couple of years. A lot of that is driven by e-commerce, and there’s still so much room to grow in the e-commerce world. E-commerce accounted for approximately 13.6 percent of retail sales in the first quarter of 2021 (a number that is steadily increasing). There is still a lot of room for that percent to increase, and that’s what is driving most industrial demand.

REBusiness: What are the types of tenants have the most demand for space right now?

Destino: The big three are distribution companies, contractors and service-type industries. There is a still a small manufacturing base, but those are the three that are largely getting the deals.

Distribution companies have all sorts of all product types: high dollar value products to regular homewares, and everything in between. Distribution also includes freight forwarding and third-party logistics companies that store and move around other company’s products. It also includes traditional companies that own, store and deliver their own product directly.

Contractors (plumbers and electricians, for example) tend to be service related and have a fleet of vehicles that need to go out to various job sites. They often occupy industrial spaces. These industries are very busy these days.

REBusiness: What types of buildings are favored amongst industrial spaces?

Destino: When you think of the buildings that would fall under the distribution-type use, they’re going to feature higher ceilings and ample dock loading positions, with quality turning radius for trucks to come and go and distribute product. Those are the number one sought-after deals right now, and they are e-commerce driven. That’s what users want and what developers are building. Other types of industries that are absorbing space (the contractors and service industries) can get away with lower-clear/ground-level loading buildings, but distribution companies are driving the market charge in terms of what is desired for buildings.

REBusiness: What makes Southern California such a healthy market for industrial?

Destino: The proximity to the Port of Long Beach and Port of Los Angeles are the primary drivers. Second is just the sheer population/consumer base that is here. There’s nearly 14 million people in the greater Los Angeles & Orange County area alone. Plus, it’s a huge distribution channel to much of the United States right through these ports.

REBusiness: How has industrial evolved over the past few years?

Destino: Over the last seven or so years, the market has tried to adjust to deal with the e-commerce revolution. That’s why there is nearly 20 million square feet of industrial space that has being built in the Inland Empire every year for the last several years: most of that is getting absorbed by e-commerce-related outfits, in one way or another. That is the evolution: older manufacturing sites, over the last seven to ten years, have either been converted to distribution space (specifically high-cube distribution space) or (in the past) they were converted to multifamily developments.

There is still a manufacturing element for Southern California/Orange County industrial. But it’s mostly higher-end products with higher markups/higher dollar values. These tends to be more specialty products that have low overall volume. Most high-volume manufacturing is going out of the state or out the country entirely.

We’re also starting to see more cold storage, food-distribution-type facilities. Similar to the trends we’ve seen with general merchandise, there’s now an emphasis on establishing direct-to-consumer food delivery channels. Especially in Southern California, people want healthier, locally sourced or organic food. Food needs to be moved from its point of origin to the consumer’s plate faster than ever before. There’s a push for cold storage, but you’re not seeing a lot of spec development for it. I think that demand will persist.

REBusiness: Low vacancy rates can mean multiple offers on available spaces — what is the breakdown for properties getting multiple offers amid so much demand?

Destino: There are a few properties that might have some sort of challenge, and those are not going to get the same volume of activity. But most deals have multiple offers.

When selecting the winning bidder, the use for the property is something to be considered. Even more important is the credit worthiness of any tenant in a lease consideration, as well as the available source of funds for a buyer. Many sales are cash deals, and the tenants that are winning a multiple bid scenario are larger credit tenants, making it difficult for smaller local regional companies to compete.

REBusiness: What’s an unexpected, potential field for industrial in the future, one that you are watching?

Destino: I’ve been expecting to see a big push for some medical device and medicine production coming back to the United States. More could be coming later, as these are costly facilities to set up. It would certainly impact industrial properties, and some of these older manufacturing buildings could, potentially, get rejuvenated.

This article was written in conjunction with Lee & Associates, a content partner of REBusinessOnline.

WHAT TO EXPECT FROM THE U.S. INDUSTRIAL SECTOR FOR THE REMAINDER OF 2021

June 2021

Whereas the trajectories of other commercial real estate sectors have experienced significant periods of decline, or have been topsy turvy, the story of industrial real estate has been one of success and triumph. Even during 2020, one of the most challenging years for the global economy on record, industrial real estate has not merely survived, it has excelled and thrived. These trends will continue throughout the remainder of 2021 and beyond. This report will analyze the underlying trends causing the success and give you an idea of what to expect from the sector in the second half of 2021.

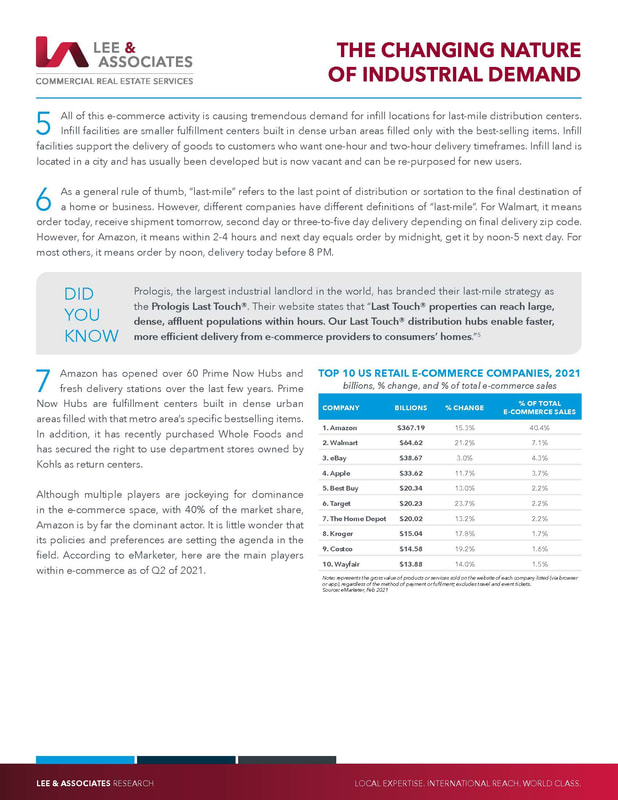

1. Of the primary sectors in CRE, industrial real estate has performed the best during the pandemic. It continues to be the preferred asset class of real estate investors1 because of the continued dominance of e-commerce. Annual rent growth will be higher than pre-COVID-19, and this increased demand will generate more development in the future.

2. These trends are neither temporary nor short-lived because of the fundamental shift in consumer behavior in the United States. U.S. e-commerce sales will make up about 14.5% of total retail sales, or $709.78 billion, this year. That percentage will grow to 18.1% of all retail sales by the end of 2024, with online sales surpassing $1 trillion for the first time, according to the firm eMarketer. Consequently, demand for industrial real estate could reach an additional 1 billion square feet by 2025. To put into perspective how much extra warehouse space is needed, Prologis estimates that e-commerce companies require 1.2 million square feet of distribution space for each $1 billion in sales. As of June 2021, over 21 million square feet were under construction in the Inland Empire alone.

3. Moreover, the long-term structural growth rate of logistics real estate has risen. Economic growth now requires more logistics real estate than in the past. Consumption has advanced as the primary driver of demand on the global level. Retail sales have a higher correlation with logistics demand growth than do drivers of the past – namely, manufacturing and trade. In addition, changes in how we consume further amplify this shift because e-commerce is more space-intensive.2

4. In terms of financing, issuance of commercial mortgage-backed securities (CMBS) had rebounded from a low in 2009. Albeit to a much lower level than pre-Great Financial Crisis levels, which peaked at $229 billion in 2007. The post-GFC3 peak was in 2019, at $98 billion. CMBS issuance fell by 40% in 2020 to $59 billion but, as with transaction volume, decidedly above the declines of the GFC. Issuance is expected to rebound over the forecast period with $70 billion in 2021, $85 billion in 2022, and $90 billion in 2023.

5. The availability rate for the industrial/warehouse sector declined for the ninth straight year in 2018, to 7.0%, before notching up to 7.2% in 2019 and 7.4% in 2020. However, it stayed well below the 20-year average of 10.4%. It is forecast to plateau in 2021 at 7.4% before notching down again to 7.3% and 7.2% in 2022 and 2023, respectively.

6. Warehouse rental rate growth has been substantially above the long-term average of 1.1% in the last eight years. Rent growth is expected to continue above that average at 4%, 3.7%, and 3.1%, respectively, in 2021, 2022, and 2023.

7. Stronger than in other sectors, Industrial total returns are forecast to equal 12% in 2021, 9.3% in 2022, and 8.3% in 2023 per ULI’s spring forecast.4

1. Of the primary sectors in CRE, industrial real estate has performed the best during the pandemic. It continues to be the preferred asset class of real estate investors1 because of the continued dominance of e-commerce. Annual rent growth will be higher than pre-COVID-19, and this increased demand will generate more development in the future.

2. These trends are neither temporary nor short-lived because of the fundamental shift in consumer behavior in the United States. U.S. e-commerce sales will make up about 14.5% of total retail sales, or $709.78 billion, this year. That percentage will grow to 18.1% of all retail sales by the end of 2024, with online sales surpassing $1 trillion for the first time, according to the firm eMarketer. Consequently, demand for industrial real estate could reach an additional 1 billion square feet by 2025. To put into perspective how much extra warehouse space is needed, Prologis estimates that e-commerce companies require 1.2 million square feet of distribution space for each $1 billion in sales. As of June 2021, over 21 million square feet were under construction in the Inland Empire alone.

3. Moreover, the long-term structural growth rate of logistics real estate has risen. Economic growth now requires more logistics real estate than in the past. Consumption has advanced as the primary driver of demand on the global level. Retail sales have a higher correlation with logistics demand growth than do drivers of the past – namely, manufacturing and trade. In addition, changes in how we consume further amplify this shift because e-commerce is more space-intensive.2

4. In terms of financing, issuance of commercial mortgage-backed securities (CMBS) had rebounded from a low in 2009. Albeit to a much lower level than pre-Great Financial Crisis levels, which peaked at $229 billion in 2007. The post-GFC3 peak was in 2019, at $98 billion. CMBS issuance fell by 40% in 2020 to $59 billion but, as with transaction volume, decidedly above the declines of the GFC. Issuance is expected to rebound over the forecast period with $70 billion in 2021, $85 billion in 2022, and $90 billion in 2023.

5. The availability rate for the industrial/warehouse sector declined for the ninth straight year in 2018, to 7.0%, before notching up to 7.2% in 2019 and 7.4% in 2020. However, it stayed well below the 20-year average of 10.4%. It is forecast to plateau in 2021 at 7.4% before notching down again to 7.3% and 7.2% in 2022 and 2023, respectively.

6. Warehouse rental rate growth has been substantially above the long-term average of 1.1% in the last eight years. Rent growth is expected to continue above that average at 4%, 3.7%, and 3.1%, respectively, in 2021, 2022, and 2023.

7. Stronger than in other sectors, Industrial total returns are forecast to equal 12% in 2021, 9.3% in 2022, and 8.3% in 2023 per ULI’s spring forecast.4

| spring-economic-forecast-report-4-21-2021.pdf | |

| File Size: | 938 kb |

| File Type: | |

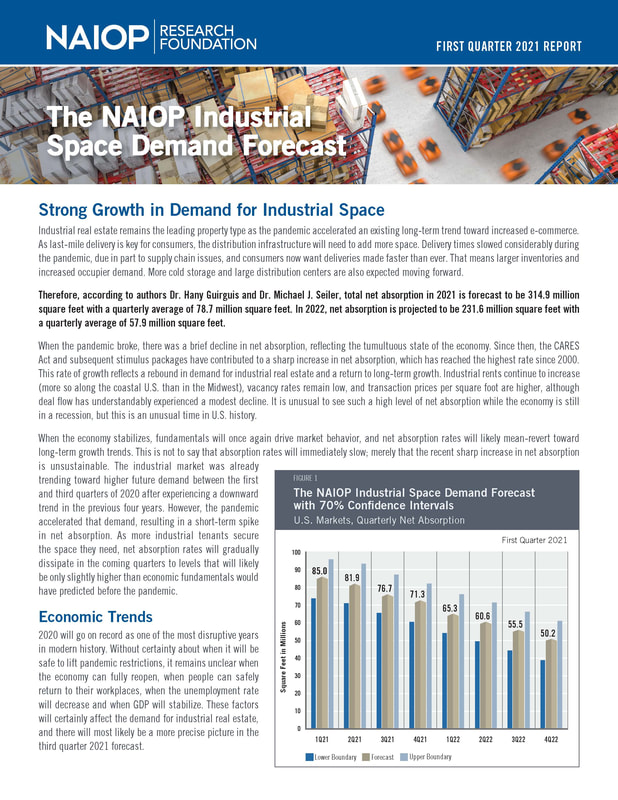

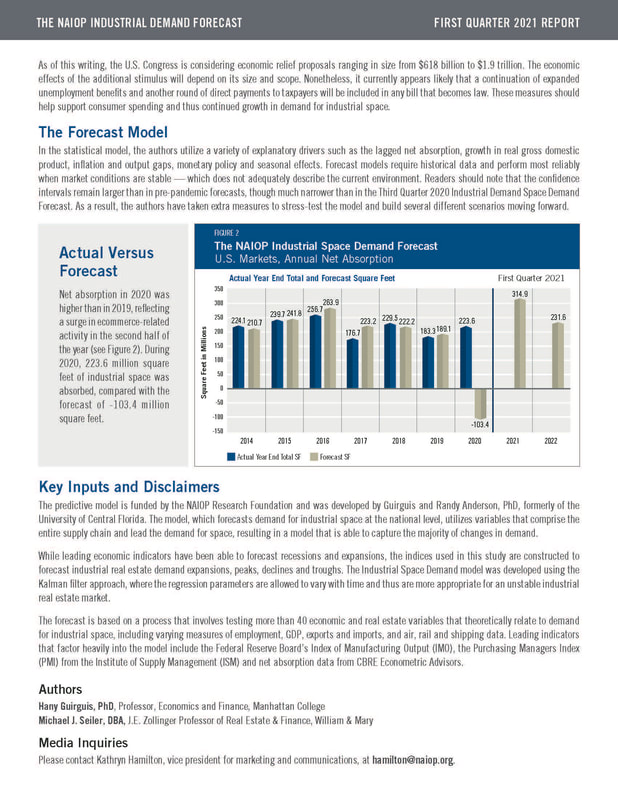

| industrial_space_demand_forecast_1q21.pdf | |

| File Size: | 843 kb |

| File Type: | |

First Quarter 2021

| amcres_winter_ind_forecast_2021.pdf | |

| File Size: | 502 kb |

| File Type: | |

First Quarter 2021

| lee_article_-_the-industrial-sector-no-end-in-sight-of-its-success.pdf | |

| File Size: | 150 kb |

| File Type: | |

December 2020

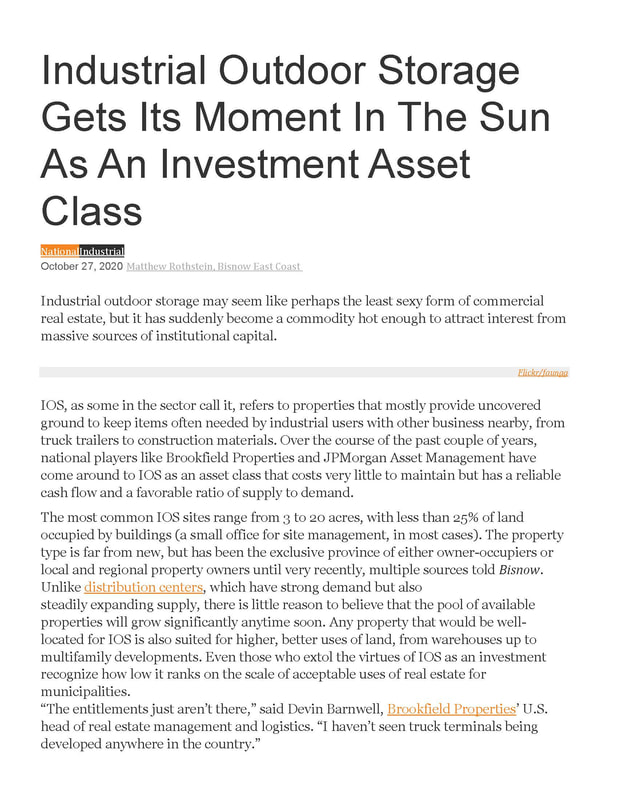

| outside_storage_article.pdf | |

| File Size: | 142 kb |

| File Type: | |

November 2020

|

“Working with a Professional

Achieves Professional Results” |

Lee & Associates

Commercial Real Estate Services 1004 W. Taft Avenue, Suite 150 Orange, CA 92865 LeeOrange.com Corporate ID #01011260 |

Christopher J. Destino, SIOR

Principal 714.454.0668 [email protected] Destino Industrial Team DRE #01447060 |