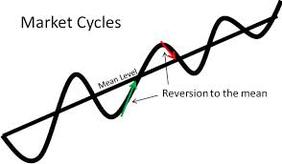

As we fast approach what could be called ‘the election of a lifetime,’ many participants in the industrial real estate industry are asking the question, ‘Where is the market going?’ This is a loaded question that encompasses both short and long term considerations. As buyers, sellers, investors, tenants and landlords all evaluate their individual situations to make decisions, each must also consider the “big questions” of life such as, “Where are we from?” “What are we here for?” and “Where are we going?” You might wonder what these questions have to do with real estate. Well, in real estate life, this directly correlates to, “What has the market done in the past?” “What is the market doing now?” and “Where is the market going?”. Therefore, in today’s post we will take a preliminary look at these three phases to give ourselves some perspective and parameters for our decision making. 1) “What has the market done in the past?” 2) “What is the market doing now?” 3) “Where is the market going?”  “What has the market done in the past?” If you have been an active participant in the real estate market over the past 16+ years, you have experienced some mighty swings. Coming out of the recession of the early 2000’s ‘.com bust’ we saw one of the greatest real estate booms from 2003 - 2007. That was then followed by one of the biggest recessions from 2008 to 2013. Now for the past 2 to 3 years we have seen incredible growth in the values of assets. With real estate cycles going up and down we must consider why this happens. Swings in the market have been caused by such things as oversupply, undersupply, lending practices and interest rate policy, global markets, local markets, and the list goes on… Accordingly, it is important to consider the specific dynamics that impact your local markets and how that relates to the decisions you are making today.  “What is the market doing now?” Well, in short, the market is evaluating the current fundamentals - financing is extremely affordable, and in Southern California vacancy is extremely low, demand is high, and new development is limited. For smaller business and owner/occupants of property between 10,000 and 100,000 SF, the choices for space are limited. Consequently, for owners it is still a “seller’s market.” As a result of this current scenario, occupants considering a move need to look at the following:

owners considering options need to look at the following:

At the present time, the market is still moving strongly, but there are more and more reservations rumbling about what is on the horizon. It is important to discuss these questions in detail with your real estate advisor so that you properly understand what you are facing in the market and how it can impact your bottom line and your business.  “Where is the market going?” While the above recap of the last 16+ years can indicate a bubble on the horizon, the fundamentals of low inventory, minimal development and higher capital reserves can help keep the next swing in better balance, hopefully. Some of this will depend on global market impact and general consumer confidence. Real estate markets do cycle and there is bound to be a shift in the current before too long; the real question is determining how long the correction will last and how deep the correction will be. Building on that idea, and given the local market dynamics in Southern California, it is safe to say that the real cause of the correction won’t necessarily be so much concerned with real estate market fundamentals (inventory, development, and financing) as it could have to do with a larger national and global market change that causes a real estate correction. As markets around the globe become even more tied together, we can expect to feel the impact of financial headwinds in a shorter period of time. The amount of debt growing around the world needs to be factored in, and also to be ascertained is in what way defaults will affect both available funds for financing deals and the impacts on consumer confidence in general. In light of all of elections, market swings, and fundamentals, any owner or occupant of real estate must be prepared to interpret the implications and evaluate any decision they are facing by looking beyond the immediate situation into the long term horizon. How are the decisions you make today going to play out over the next 3-10 years? In conclusion, Whether buying, investing, selling, or leasing, we must carefully consider the options we have set before us.My team and I can help you to evaluate those choices and any potential positive or negative impact. We want to be a strategic partner with you so that your goals are fully realized. Comments are closed.

|

AuthorChristopher J. Destino, SIOR, a Principal at Lee & Associates, is an engaging, responsive professional who enjoys working closely with his clients and helping them succeed. Categories

All

|

|

“Working with a Professional

Achieves Professional Results” |

Lee & Associates

Commercial Real Estate Services 1004 W. Taft Avenue, Suite 150 Orange, CA 92865 LeeOrange.com Corporate ID #01011260 |

Christopher J. Destino, SIOR

Principal 714.454.0668 [email protected] Destino Industrial Team DRE #01447060 |