Making a real estate decision can be an exciting time, especially in today’s market. For Buyers/Tenants, there are opportunities that a new facility provides, such as a better location, improved amenities, or utilizing a more efficient layout. Selling or renting an owned property can dramatically improve your cash flow situation. In today’s market there are other factors that must also be taken into consideration when deciding on renting, buying, or selling. Let’s briefly look at three (3) considerations when evaluating your decision.

First, why are you making a change? Urgency, necessity, or opportunity…. How does this affect you?

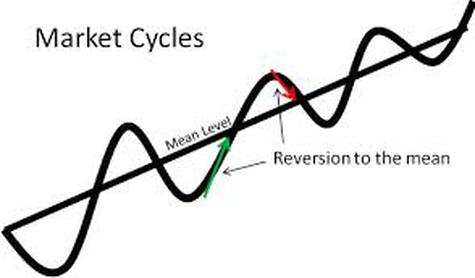

Secondly, where are we in the Market Cycle? Despite an overall long-term trend upward, real estate markets generally reach peaks and valleys approximately every 7-9 years. By many economists’ perspective, we have been trending up since around late 2009 or early 2010. In either estimation, we are certainly near a peak, but deals must still be done. Therefore, how does the current Market Cycle affect your deal?

Thirdly, what is the Availability and Choice?

Presently, in the industrial real estate market in southern California, availability and vacancy are very low (less than 1.5%), and new construction of large buildings is underway, but overall choices are few. Recognizing the availability and options will help you to choose your next steps wisely. So how does this affect you?

Contact Christopher J. Destino of the Destino Industrial Team to help evaluate your scenario and chart a course to accomplish your goals. Comments are closed.

|

AuthorChristopher J. Destino, SIOR, a Principal at Lee & Associates, is an engaging, responsive professional who enjoys working closely with his clients and helping them succeed. Categories

All

|

|

“Working with a Professional

Achieves Professional Results” |

Lee & Associates

Commercial Real Estate Services 1004 W. Taft Avenue, Suite 150 Orange, CA 92865 LeeOrange.com Corporate ID #01011260 |

Christopher J. Destino, SIOR

Principal 714.454.0668 [email protected] Destino Industrial Team DRE #01447060 |