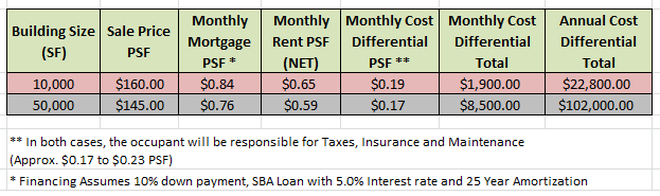

Whether this year or sometime in the future, the time is coming when you will be faced with a real estate decision - is buying or leasing the best strategy for you and your business? This is an important decision that must be considered objectively prior to charting your course. Let us look at 3 aspects to evaluate the buy vs lease decision. 1 Cost 2 Capital 3 Company History COST What is the monthly budget for the company’s building(s)? The overall occupancy cost per square foot (“PSF”) is the base NET rent or mortgage cost PSF plus operating expenses. The additional operating expenses (taxes, insurance and maintenance) are constant in either scenario. Generally, it costs more PSF to purchase than to rent a warehouse. So, how much more and what are the benefits in doing so? Alternatively, how much more building can you get if you rent instead of buy? REAL LIFE SCENARIO:  Potential Benefits of Ownership or Leasing Ownership Benefits:

A professional real estate agent can help you evaluate the cost basis of each scenario and can also work with your CPA regarding the above benefit considerations.  CAPITAL SBA financing with only 10% as the down payment. If 10-15% cash is the bulk of your working capital, it may not be best to tie that money up in a new building. Other items need capital:

Businesses need flexibility and if all the working capital is tied up in the down payment that could put you in a pinch should one of these items come up. Therefore, if you do not have significant cash reserves in addition to the down payment, renting could be the better alternative. COMPANY HISTORY Where will the company be in the next 3, 5, 7 and/or 10 years? Questions to Consider:

In Conclusion, Considering these three important items, let me help you to determine what the current price on the market is, and if you have sufficient down payment. For some businesses, buying is a great strategy. However, for many, leasing is a superior option based on the nature of their business and future objectives. Comments are closed.

|

AuthorChristopher J. Destino, SIOR, a Principal at Lee & Associates, is an engaging, responsive professional who enjoys working closely with his clients and helping them succeed. Categories

All

|

|

“Working with a Professional

Achieves Professional Results” |

Lee & Associates

Commercial Real Estate Services 1004 W. Taft Avenue, Suite 150 Orange, CA 92865 LeeOrange.com Corporate ID #01011260 |

Christopher J. Destino, SIOR

Principal 714.454.0668 [email protected] Destino Industrial Team DRE #01447060 |